Before going forward, we need to clarify some points for you to understand the process and SOF allocations in detail.

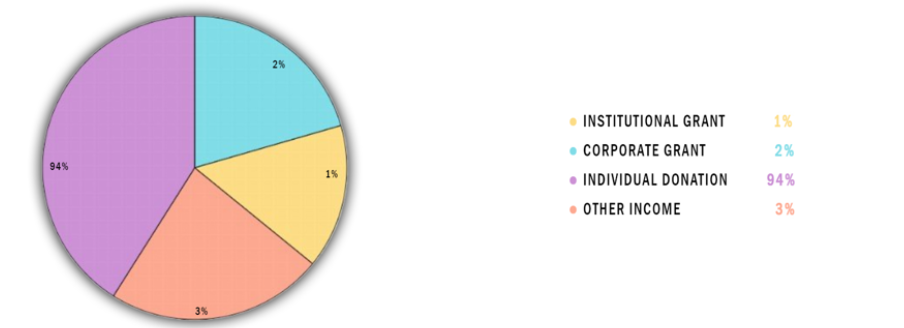

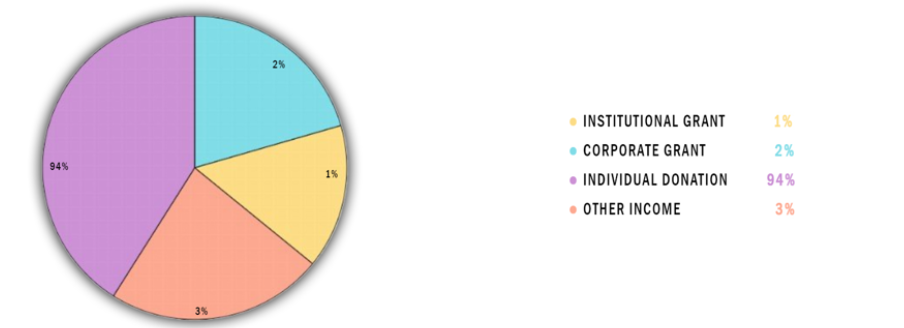

Sources: Where our money came from?

Before going forward, we need to clarify some points for you to understand the process and SOF allocations in detail.

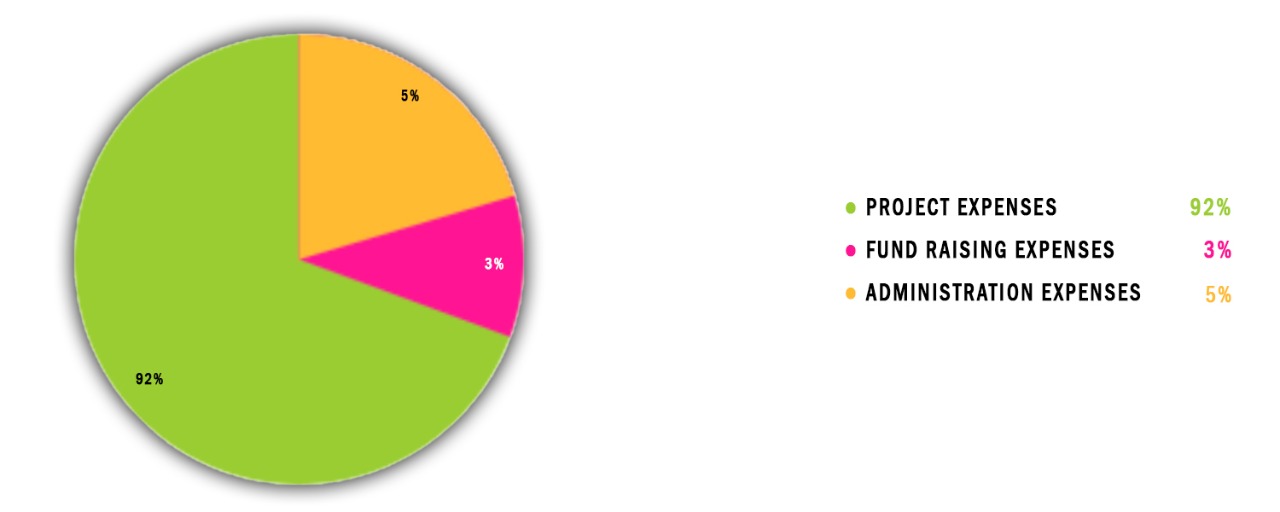

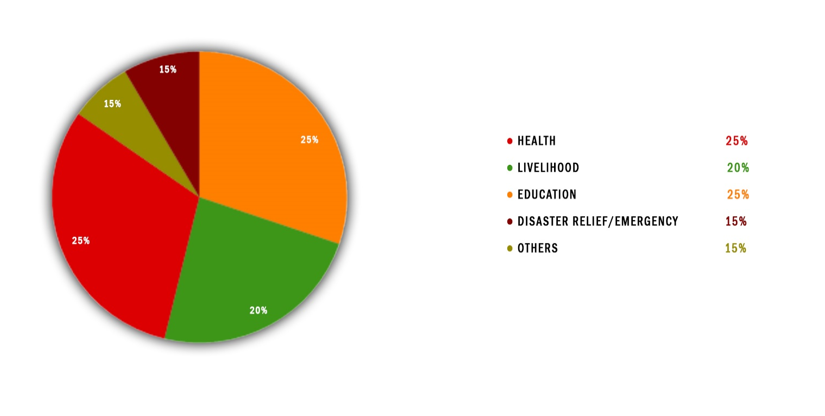

As Raah-e-Najaat not-for-profit organization, NGO rely on a variety of sources for funding projects, operations, salaries, and other overhead costs. Because the annual budget of Raah-e-Najaat can be in the hundreds of thousands (or even millions) of Rupees (INR), fundraising efforts are important for our existence and success. Funding sources include membership dues; private sector contributions, for-profit making companies; philanthropic foundations; grants from local, state, and federal agencies, as well as foreign governments; and private donations. Individual private donors can comprise a significant portion of our funding. Some of these donations come from wealthy individuals. However, Raah-e-Najaat also can rely on a large number of small donations rather than a small number of large donations. Despite our independence from government, on the other hand a number of NGOs rely heavily on government funding to function. We are committed to spending all grants and donations in the most efficient way and to help those in greatest need by setting up effective programmes. Additionally, our management maintains highest standards of accountability through internal and external audits as well as regular peer reviews.

Non-governmental organizations (NGOs) are nonprofit groups organized independently of the government by private citizens. They can pursue a wide variety of goals for social, developmental, or political purposes and can operate on a local, national, or even internationally

Raah-e-najaat foundation can accept donations from private individuals, for-profit companies, charitable foundations, and governments, whether local, state, federal, or even foreign. As nonprofit entities, we also can charge membership dues and raise the other income.

Private donations to Raah-e-Najaat are tax deductible if the donating organization has qualified for form 80G under income taxt. Not all NGOs have that status, so donations should not be considered automatically deductible. Make sure you check before taking them off your taxes.